This Update will be quick as the Middle East is dominating research resources!

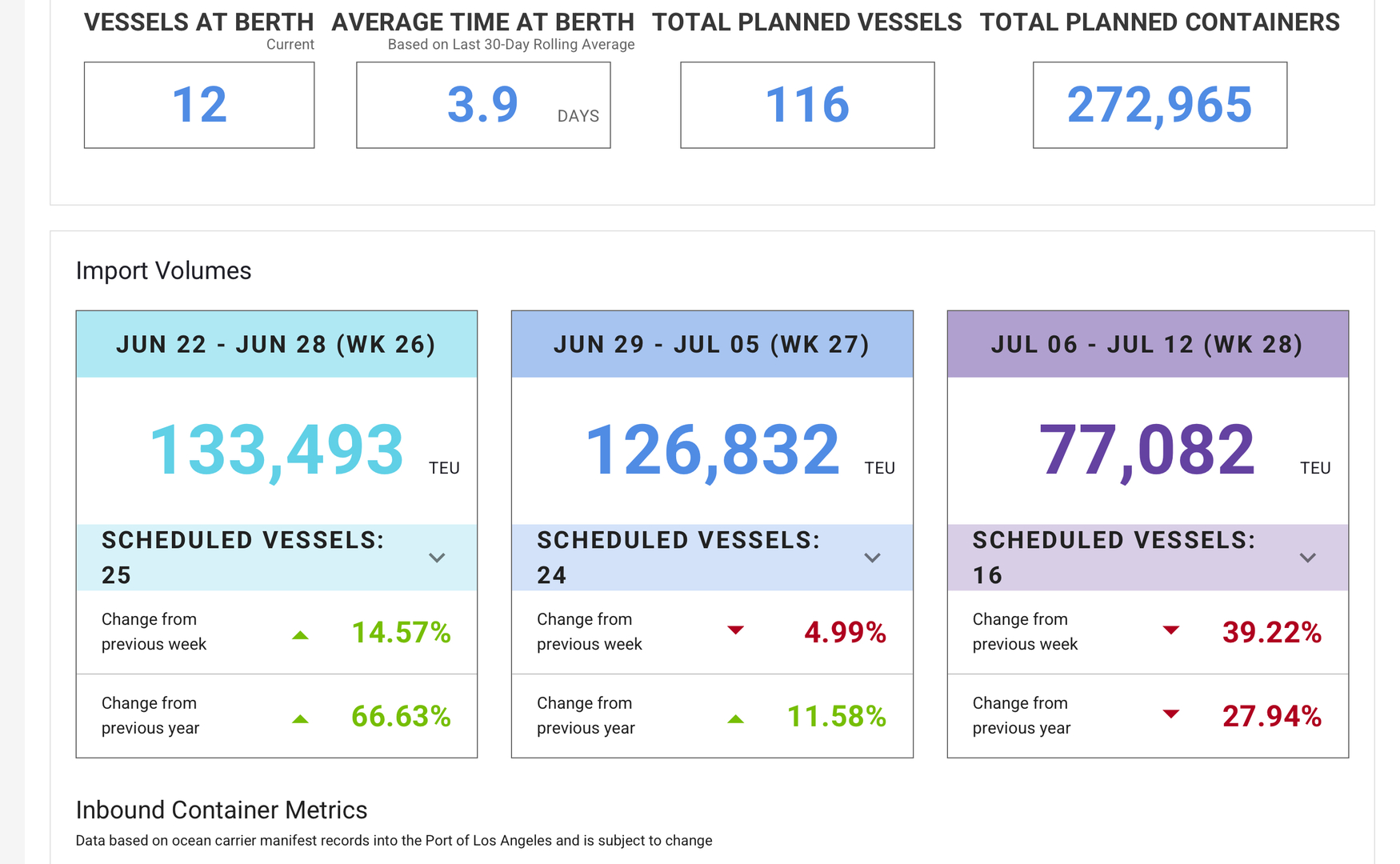

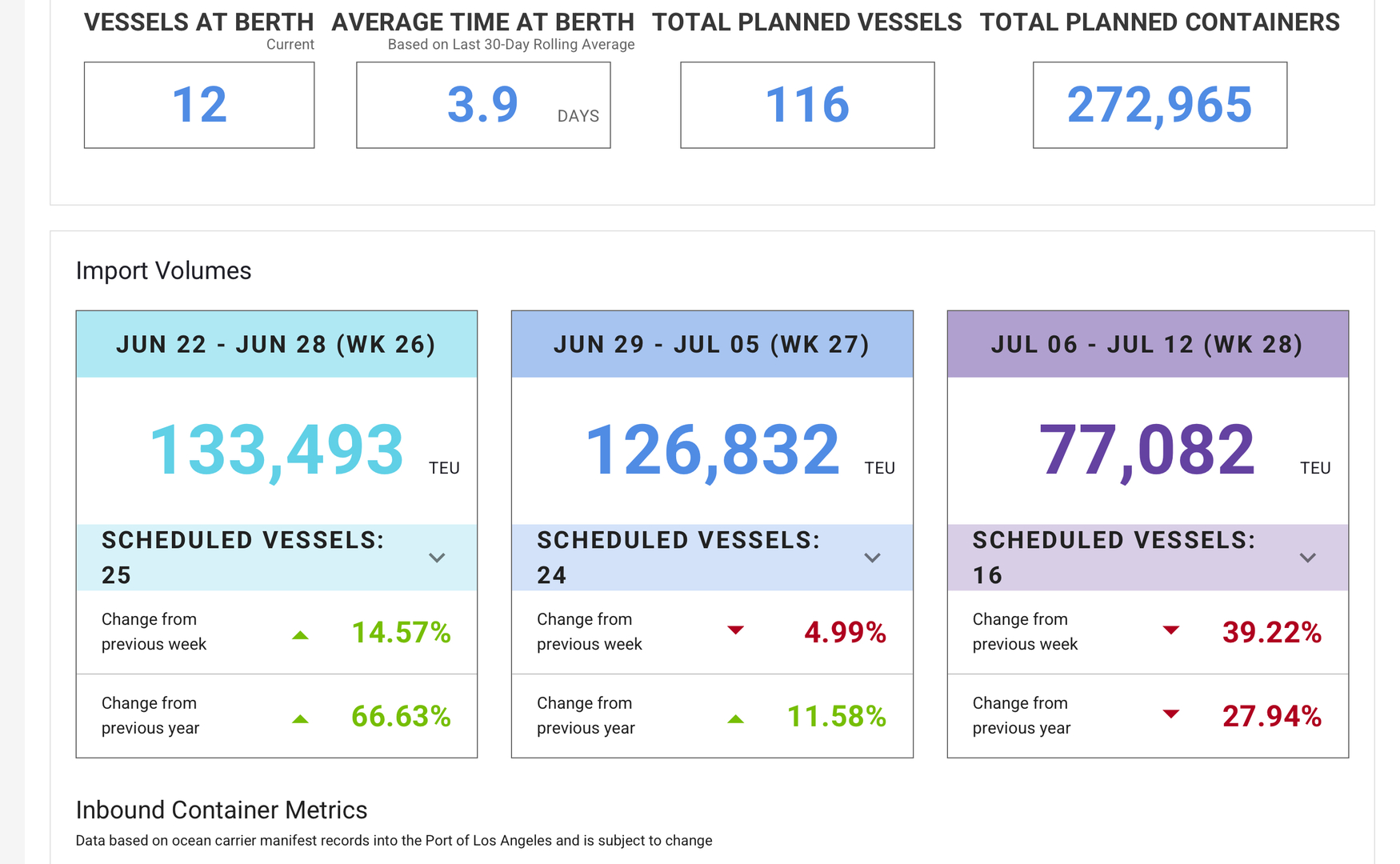

1. Port of Los Angeles Data shows fairly stable container flows at TEU 134k and then 127k for next two weeks but then there is a pretty massive fall to TEU 77k in the week of July 6 to July 12. If that happens container volumes would fall by 28% YoY. Picture is on top. I remind you that 40% of US containerised imports enter the US through Los Angeles and 50% of those inflows are from China.

2.The US Treasury TICS data for April showed foreigners selling US$ 51 bn of US Treasuries, Notes & Equities - split USD 21 bn private and USD 30bn public. But that is small beer compared to foreign holdings of US$ 18 trn in equities and US$ 14 trn in fixed income. According to a "must-read-paper by the BIS - "US dollar’s slide in April 2025: the role of FX hedging" what happened was that Asian investors started hedging their USD asset exposures big time. But they did not sell. European investors seem to have neither sold nor hedged. The BIS makes the point that is foreign investors buy US assets and hedge them at the same time there is little effect on the exchange rate as the capital inflow to buy the asset is offset by the outflow to hedge the US$. But if unhedged asset positions are built up over years and then hedged the effect on the USD can be big.

(https://www.bis.org/publ/bisbull105.htm)

3. On the Big Beautiful Budget, i wrote to you recently (The taxation of foreign investments in the US - JUne 6 2025)about Section 899 as a tax foreign investments in the US. That could be a potential disruptor of foreign capital flows to the US. S.899 has been watered down in the senate in two ways. First, the maximum rate of taxation of passive income from a foreign investment is "limited" to 15%. Second, investments in US Tresuries and Notes are exempt. The measures are still to be imposed on investments stemming from countrries deemed unfriendly to the US, And it is still an additional tax on investment that the US needs to plug its deficits. But it is less lethal than before.