Shipping Data.

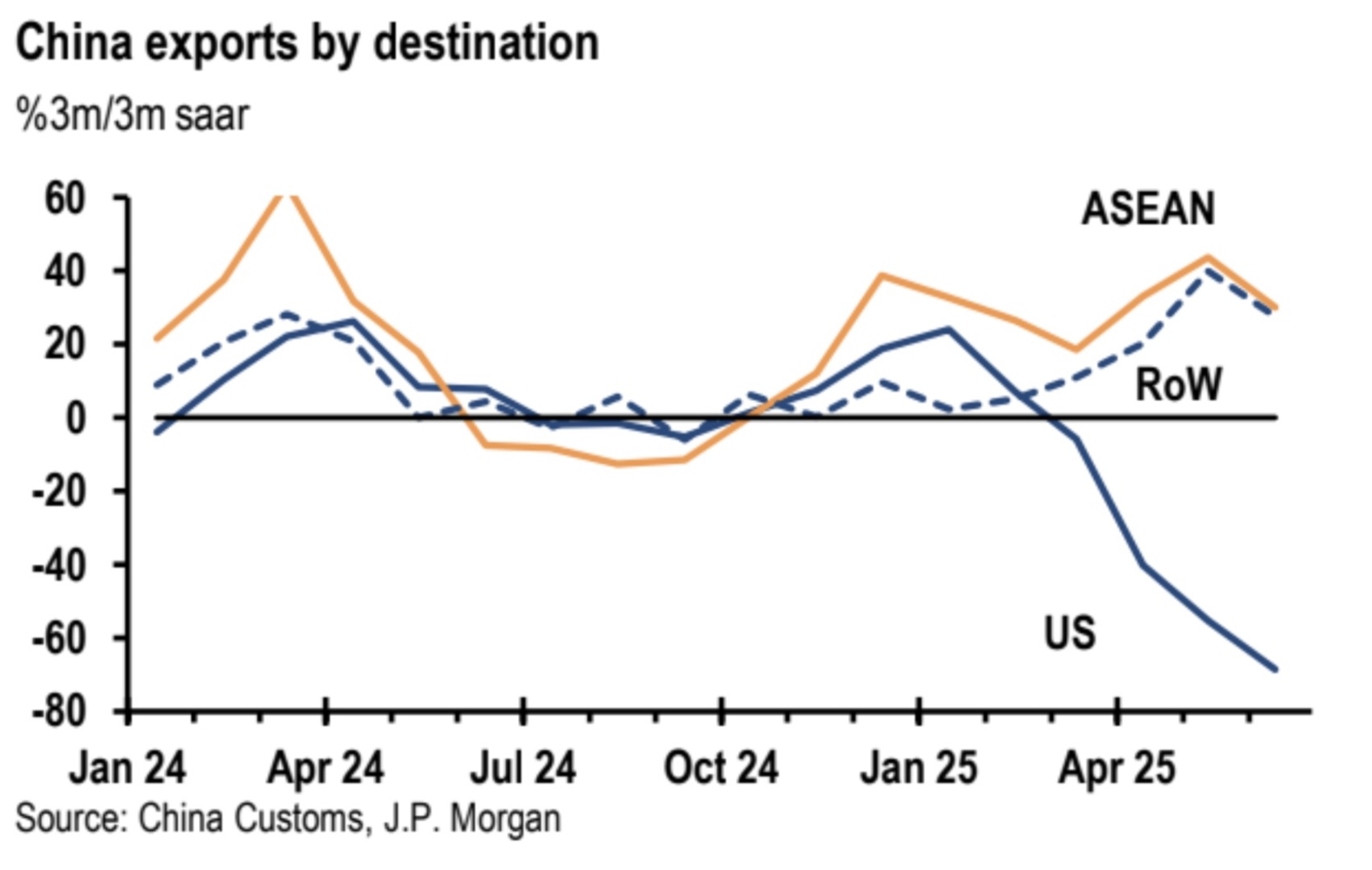

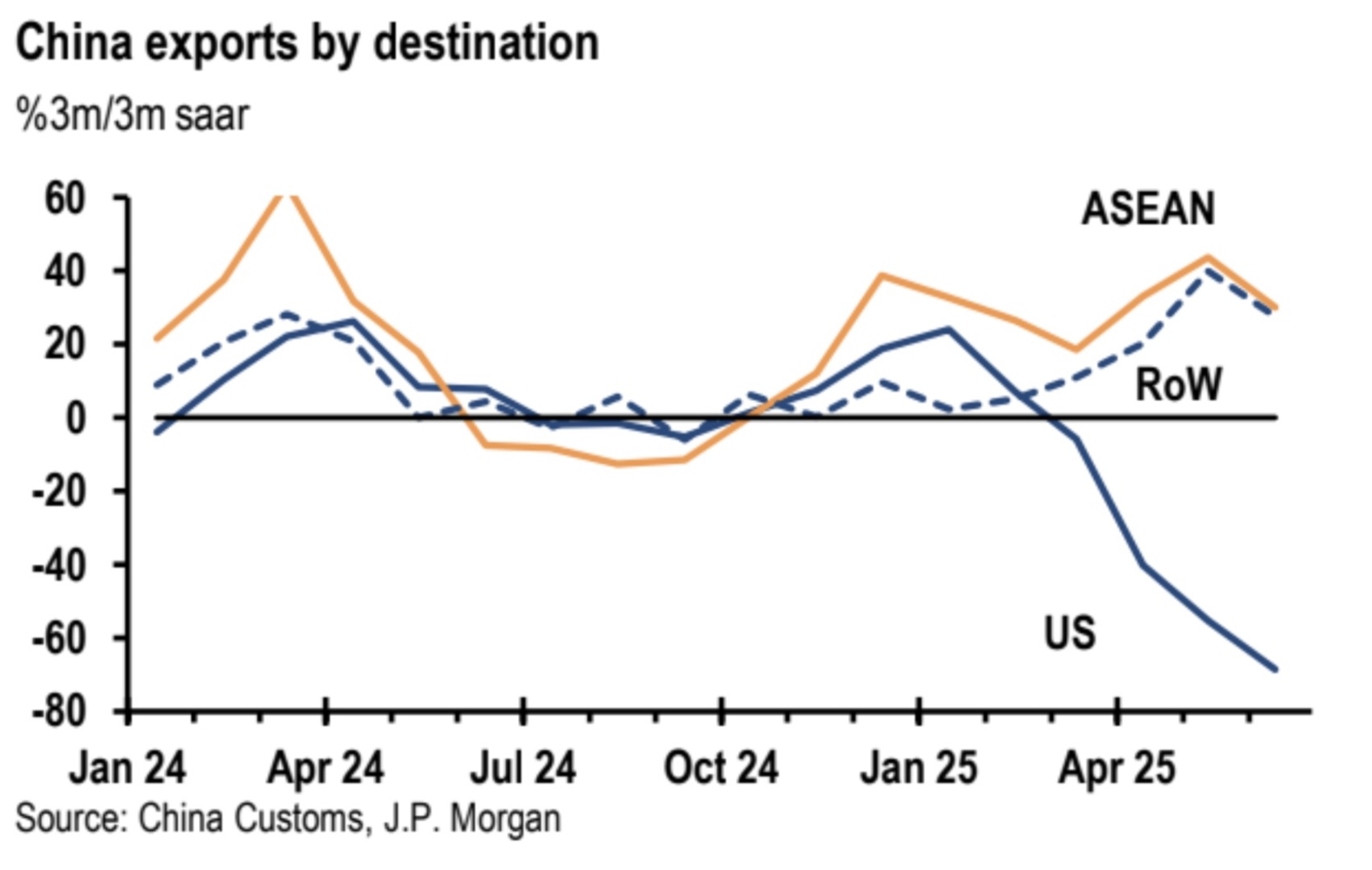

So far, Chinese total exports have weathered US tariffs without a contraction. Exports to other places than the US have grown and more than offset losses to the US. That is "normal" as US exports are only US 500bn out of a total of nearly US$ 4 trn. The question is: what will happen if Trump's tariffs cause GDP in China's other trading partners to fall?

The trade data for this morning show three things:

1. The Port of Los Angeles Data shows a rather big 12% YoY drop in expected container arrivals for next week (July 20 - 26) and a 22% YoY fall the week after that. The third week out is always "iffy" as it is heavily influenced by late bookings. But this is the first time a big drop is anticipated 7 days away.

2 The Chinese fast-track port statistics for the first and second weeks of July also show drops in shipments to the US & relatively buoyant shipments to elsewhere with total traffic up about 5% YoY for containers and +16% for other freight. Sources: China Container Freight Index (CCFI); the Shanghai Container Freight Index (SCFI) and other port authorities.

3. The Chinese offical customs data for June, slightly older, show China's total exports increasing by 9.8% YoY and 0.9% MoM. The figure above shows the pattern. Exports to the US were down nearly 16% on the year but bounced after the Geneva/London framework agreement by over one fifth.