Korea after the elections. Lee Jay-Keung has one big advantage in that his party controls parliament and he is president. But he faces many daunting challenges that he does not control: 1. The economy is 87% international trade. If US 25% tariffs are imposed it will p... Read More

Reports LibraryShowing All Results

Update: US Container traffic and Escalation in the Baltics and Ukraine?

Investment Conclusion President Trump will get more extreme on tariffs. Watch China & the EU. Russia will escalate in Ukraine after a significant hi tech defeat. Neither is bullish for financial assets. If Putin escalates in the Baltic on top of his current escalation t... Read More

Uncertainty as a Certainty – Wealth Preservation Portfolio

Uncertainty as a Certainty – Wealth Preservation Portfolio Investment Conclusion There are no changes to the Wealth Preservation Portfolio this week. The ruling by the US Court of International Trade (USCIT), that the President’s use of the International Emergency Ec... Read More

Trump Trade Policies in disarray

The US Court of International trade has ruled that the Trump Administration’s trade tariffs, both reciprocal and fentanyl, are illegal. The US Court of International Trade says Trump overstepped his authority - using a 1977 federal economic emergency law. The law does not ... Read More

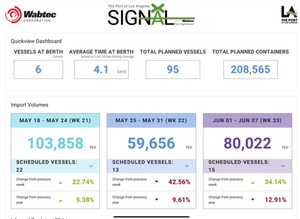

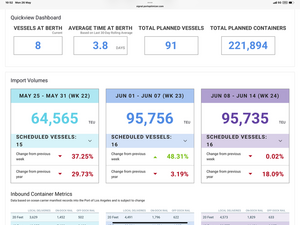

Port of Los Angeles Data for Container Ship Arrivals up to June 14

The Port of Los Angeles Data as of May 26 for the period to June 14 shows some recovery of inbound container verssels to +/- 100,000 TEU per week. This level remains well below the same period in the previous year. Evidence of a surge in shipments from China is absent. Read More

Wealth Preservation Portfolio (WPP) - Update

Wealth Protction Portfolio - Update Investment Conclusion There is no change in my pessimistic view of the current rally in risk assets. The only change in the WPP this week is to add some risk diversification in the form of Hong Kong equities (the Tracker) – see: ... Read More

Doing an Odd Thing – Hong Kong

Doing an Odd Thing – Hong Kong Investment Conclusion I am buying some HK equities. HK assets are a diversification of US policy risks. The worse it goes for the US, the more money pours back into HK. The HK$ peg does the rest. The inflows surge domestic liquidity. ... Read More

US Treasury International Capital Data for March - Too early to say!

Short US$ is a core position in the Wealth Preservation Portfolio. Investment flows in and out of the US$ need to be monitored. The TICS data for the month of March do not provide any indication of substantial outflows happening. But that could only be expected after April ... Read More

Port of Los Angeles Container Data Bookings May 18 to June 7

The Port of LA accounts for 40% of all ship board container traffic into the US. About 50% of its inward shipments are from China. So its a good indicator. The port is showing year on year falls in total inward container shipments between May 25 and June 07 of between 1... Read More

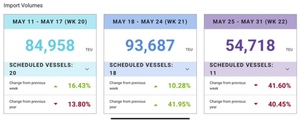

Update: US Import Surge? Port of Los Angeles Update May 15, 2025 - No surge yet!

Port of Los Angeles in-bound container traffic forecast for next three weeks. The forward booking for container traffic (in TEU) until May 31 does not yet show a surge in US imports. The data through May 31 (week 22) are shown in the graphic updated on May 15, 202... Read More

March 2025_Thumbnail.jpeg)